Understanding Closing Costs: Buyers & Sellers

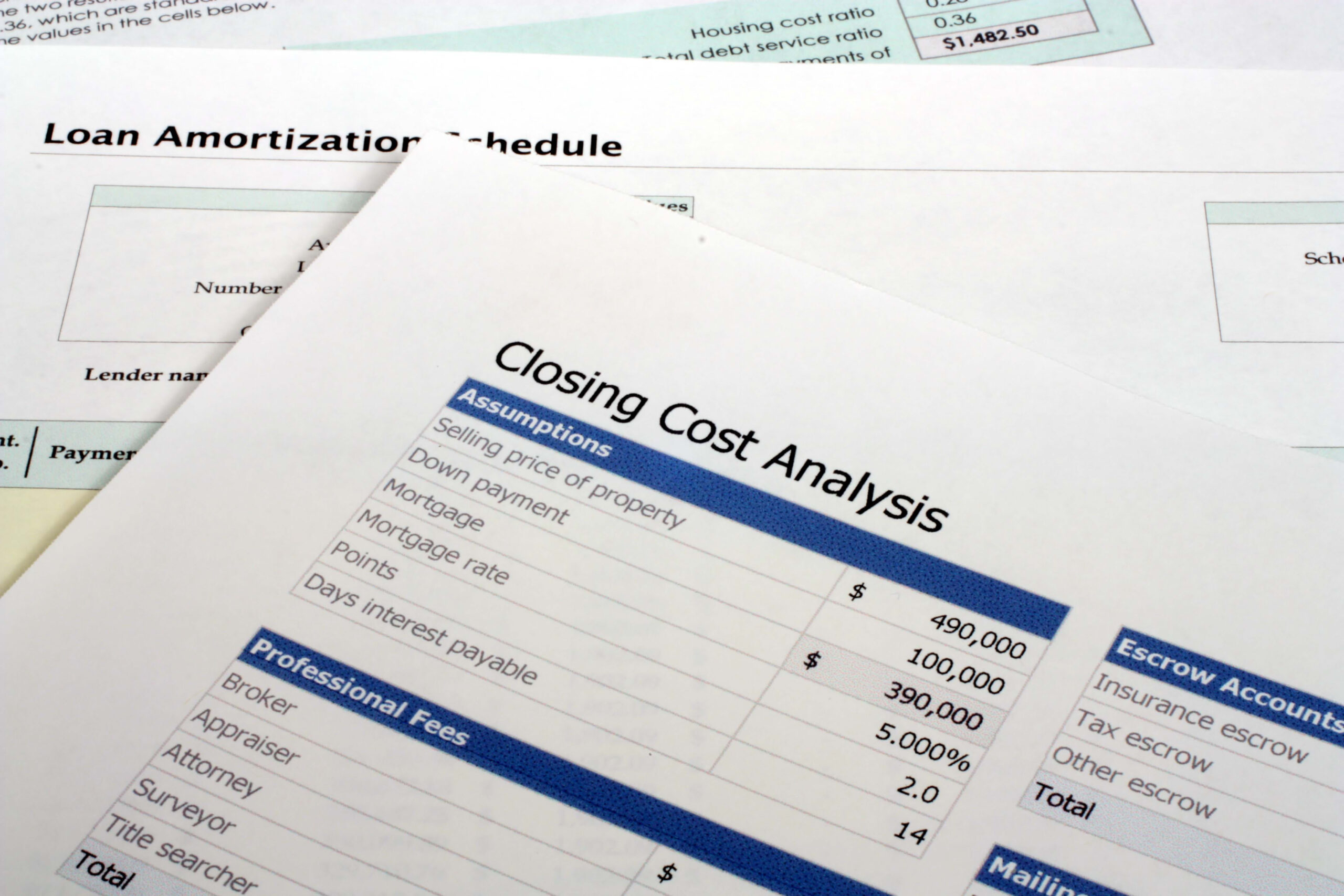

Buying or selling a home can be an exciting and often complex process. One crucial aspect that both homebuyers and sellers need to be aware of is closing costs. Closing costs are the fees and expenses associated with the finalization of a real estate transaction. They encompass various charges that are typically paid at the closing of a home sale. In this article, we will delve into the concept of closing costs, explore the different types of fees involved, and provide useful insights for both buyers and sellers.

For buyers, understanding these costs is crucial for budgeting and financial planning. For sellers, they should be aware of the potential expenses they might encounter during the listing and closing process. By having a comprehensive understanding of closing costs, both parties can make informed decisions and avoid any unpleasant surprises.

Closing Costs for Buyers:

1. Loan-Related Costs: These fees are associated with obtaining a mortgage loan and may include application fees, loan origination fees, credit report charges, and discount points.

2. Title and Escrow Fees: These costs cover the title search, title insurance, and escrow services to ensure a smooth transfer of ownership.

3. Appraisal and Inspection Fees: Buyers often need to pay for an appraisal to determine the fair market value of the property. Additionally, inspection fees may be required to assess the condition of the home.

4. Attorney Fees: Depending on the jurisdiction, buyers or sellers may choose to hire an attorney to handle legal aspects of the transaction.

5. Property Taxes and Insurance: Prorated property taxes, homeowners’ insurance, and mortgage insurance (if applicable) may be included in the closing costs.

6. Recording and Transfer Fees: These fees are associated with recording the new deed and transferring ownership of the property.

It’s important to note that closing costs can vary significantly based on factors such as the location of the property, the purchase price, and the mortgage lender. As a general rule of thumb, closing costs for home buyers typically range from 2% to 5% of the purchase price of the home. For example, on a $300,000 home, closing costs would likely range from $6,000 to $15,000.

Closing Costs for Sellers:

1. Realtor Commissions: This is the compensation the buyer’s and seller’s agents receive for the home sale, as a percentage of the final purchase price. The home seller most commonly pays both commissions.

2. Title Fees: The costs associated with transferring the property deed from the seller to the home buyer.

3. Property Taxes: If any unpaid property taxes remain on the home, the seller will be responsible for paying the amount owed at the time of closing.

4. Homeowner’s Association (HOA) Fees: If the home is a member of a HOA and any unpaid fees remain on the home, the seller will be responsible for bringing those current.

For homebuyers, it’s essential to budget for closing costs in addition to the down payment. Failure to do so can lead to financial strain or even jeopardize the ability to complete the purchase. Sellers should also consider the potential impact of closing costs on their net proceeds. Being prepared and understanding the expenses involved can help both parties navigate the closing process with confidence.

Understanding closing costs is paramount for both homebuyers and sellers. By familiarizing themselves with the different types of fees involved and seeking clarification from their real estate agent or mortgage lender, individuals can navigate the closing process with greater ease. Remember to budget accordingly and obtain estimates specific to your situation. Being well-informed about closing costs ensures a smoother transaction and a more positive homebuying or selling experience.